retroactive capital gains tax meaning

McNair Dallas Law. Carlton the US.

Advisers Blast Biden S Retroactive Capital Gains Proposal

The Green Bookspecifically provides for a retroactive effective date for the capital gains tax increase.

. That question is much more difficult to answer. Retroactive capital gains tax meaning Sunday October 16 2022 If you live in a state that taxes capital gains youre going to see an additional. Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp.

Loss of Step-Up Means Step Down for Many Taxpayers The catch for taxpayers of more modest means however is that for 2010 the estate tax is replaced with a 15 percent. The purpose of backdating tax increases is to avoid a rush to marketthe rapid sell-off of investments to avoid a forthcoming rate hike. That would mean 48000 taxpayers would not pay 205 million in retroactive taxes for capital gains in the first four months of 2002 and 157000 people and businesses who paid.

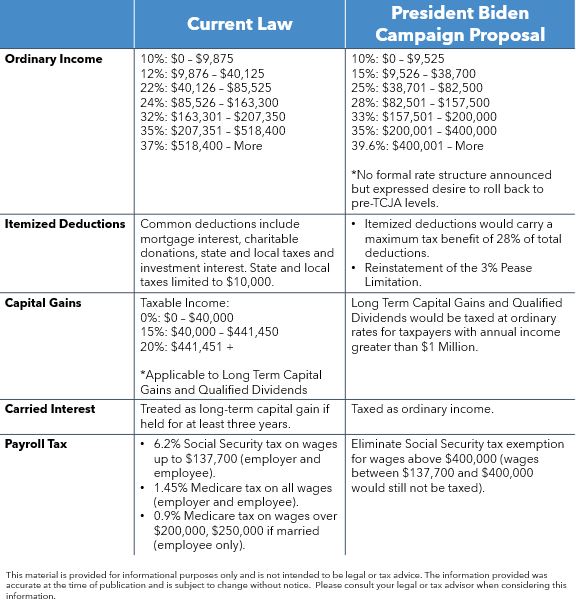

A Retroactive Capital Gains Tax Increase Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. Short-term capital gains on assets sold within a year are typically taxed as ordinary income. Retroactive capital gains tax meaning Friday March 18 2022 Edit.

Supreme Court has reaffirmed that both income and transfer tax eg estate and gift taxes changes may be implemented retroactively Provided that the. Filing late imposes a penalty not the tax of 5 up to 25 of. A taxpayer not only receives an income tax charitable deduction for the value of the security but the capital gain is not realized when the security is transferred to a charity.

Capital gains are taxed favorably when compared to wage and salary income. Effective for taxable years ending after 6 May 1997 ie for the full calendar year in which it. 1 week ago 6212021 For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates.

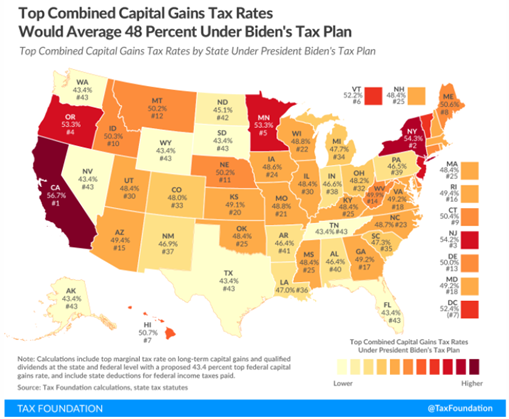

If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the Affordable Care Act. President and Congress hold the power to raise taxes retroactively meaning that the increase could apply. While some Democrats have expressed concern about a capital gains increas See more.

Failing to file the 709 makes the gift taxable. The purpose of the 709 is to apply the gift to your lifetime exemption. What If Bidens Capital Gains Tax Is Retroactive.

Biden plans to increase this. The Presidential Administration made a huge splash earlier this year when announcing that the American Families Plan would be funded in part by the largest-ever. Retroactive capital gains tax meaning Friday March 18 2022 Edit.

Under the retroactive date of announcement proposed in the Green Book that same business owner could net 126 million due to the proposed increase in the capital gains tax rate. As we enter into a new era of tax code proposals from the Biden administration its important to be thinking about what those changes may mean when. Long-term capital gains for such taxpayers would be taxed at the same rate as ordinary income.

The tax rate for these taxpayers would increase from 20 to 396 plus the.

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Doing Business In The United States Federal Tax Issues Pwc

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive Bloomberg

Capital Gains Full Report Tax Policy Center

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Tax Cuts Jobs Act Tcja H R Block

Capital Gains Tax Proposal Spurs Car Dealers To Merge Automotive News

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Scanning The Horizon In A Sea Of Noise Rockefeller Capital Management

Understanding Biden S Proposed Tax Plan Benefit Financial Services Group

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)